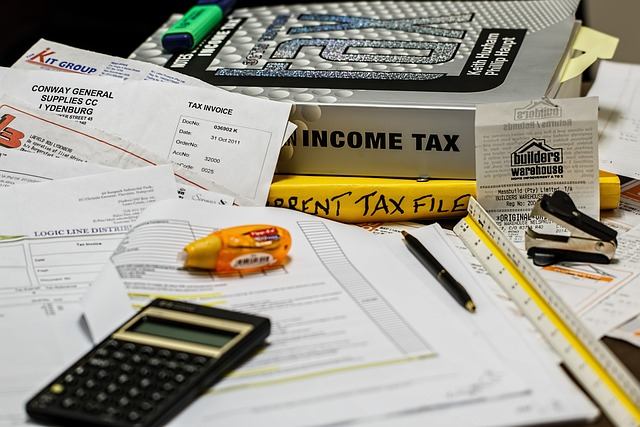

A Whirlwind Tour of Taxes: How to Navigate and Reduce Your Tax Bill

Ah, taxes. We either love 'em or loathe 'em, but they are as sure as the sun rises. Wondering why we pay taxes, where they go, or even how to reduce your tax bill? Well, you're in luck! Sit tight as we journey through the history and importance of taxes—and share some handy tips to help you steer through this sometimes baffling terrain.

A Brief Tax History: Ancient Obligation to Modern-Day Necessity

Understanding the historical context helps us appreciate how taxes have transformed from simple contributions in ancient civilizations to the intricate systems we have today.

Taxes in Ancient Egypt

Taxes helped support the pharaoh’s government and public infrastructure, funding key projects like irrigation systems.

Taxes in the Roman Empire

The Romans created a census-based system to assess citizens' wealth and determine their tax responsibilities, allowing them to manage vast territories effectively.

Taxes in Ancient China

China used a land-based taxation model, where citizens paid a portion of their produce. This system contributed to social balance and economic stability.

Feudal Taxes in Medieval Europe

In exchange for land use and protection, peasants paid taxes to feudal lords—contributions that helped support defense and governance.

Emergence of Income Tax

Income tax arose in the 18th century, initially in Britain, and became widespread to fund wars and social services. In the U.S., it was established permanently in 1913 with the Sixteenth Amendment.

Purposes of Today’s Complex Tax System

Taxes today serve multiple roles:

Funding government services (e.g. infrastructure, education, healthcare)

Encouraging equity via progressive rates and tax credits

Promoting growth with deductions and capital gains incentives

Why Isn’t Everything Tax-Free?

Civilization comes at a cost. Our taxes fund the systems and services that keep society functioning and protect shared resources.

Navigating Tax Filing and Tax Types

From income and capital gains to sales and estate taxes, each plays a part. When filing, use trusted software, the IRS website, or consult professionals to ensure accuracy.

Strategies for Reducing Your Tax Bill

1. Maximize Deductions

Review your eligible deductions, including:

Medical costs

Business expenses

Charitable donations

2. Contribute to Retirement

Adding to an IRA or 401(k) reduces taxable income today and helps secure your future.

3. Claim Applicable Tax Credits

Credits like the Earned Income Credit or energy efficiency incentives directly lower your tax owed.

4. Self-Employed? Consider Business Structure

Forming an LLC or S Corp may reduce your tax liability. Understand self-employment taxes and how to account for home office deductions and retirement contributions.

5. Consult Professionals

The right financial planner or tax pro can customize a strategy that aligns with your goals. Learn more in our guide on retirement timing mistakes to avoid.

Minimizing Taxes on High Income

Make tax-deductible retirement contributions

Understand payroll tax thresholds

Deduct student loan interest where eligible

Donate to charity

Claim home office expenses

Use estimated tax payments to avoid penalties

Read more on evolving financial opportunities like crypto’s potential.

Common Tax FAQs

Q: How can I reduce my tax bill?

A: Use deductions, retirement contributions, and credits. Consult a pro for tailored advice.

Q: What if I file or pay late?

A: Penalties and interest can pile up. The IRS offers payment plans for qualifying individuals.

Q: Can I claim dependents?

A: Yes, if they meet IRS criteria, you can reduce your taxable income and gain credit eligibility.

Q: Are taxes funding programs I don’t support?

A: While you may not agree with all allocations, taxes collectively fund vital systems for public benefit.

Recap: Taxes in a Nutshell

They’ve been around forever—from Egyptian grains to American payroll

They fund essential services and support economic fairness

Smart planning reduces your liability through deductions, credits, and retirement strategies

Conclusion

Taxes may not be fun, but understanding them gives you control. Whether you're self-employed, a high earner, or just getting started, staying informed—and asking for help when needed—can put money back in your pocket.

This article is brought to you by the wizard behind the scenes with 23 years of experience, Dan Dillard. Of course, with his workshop of helpers including some handy hi-tech sourcing.

If you’re finding it challenging to stay on top of all the changes, connect with our financial planning professionals by scheduling a no-obligation call. At NEST Financial, we can help make crypto not quite so cryptic.

Find us on: LinkedIn | Facebook | Yelp | Twitter

If you like reading more entrepreneurial stories in Austin, check out Dan’s other company foundingAustin. If you're into podcasts, click here.

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only. These are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net